Renters Insurance in and around Savannah

Welcome, home & apartment renters of Savannah!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

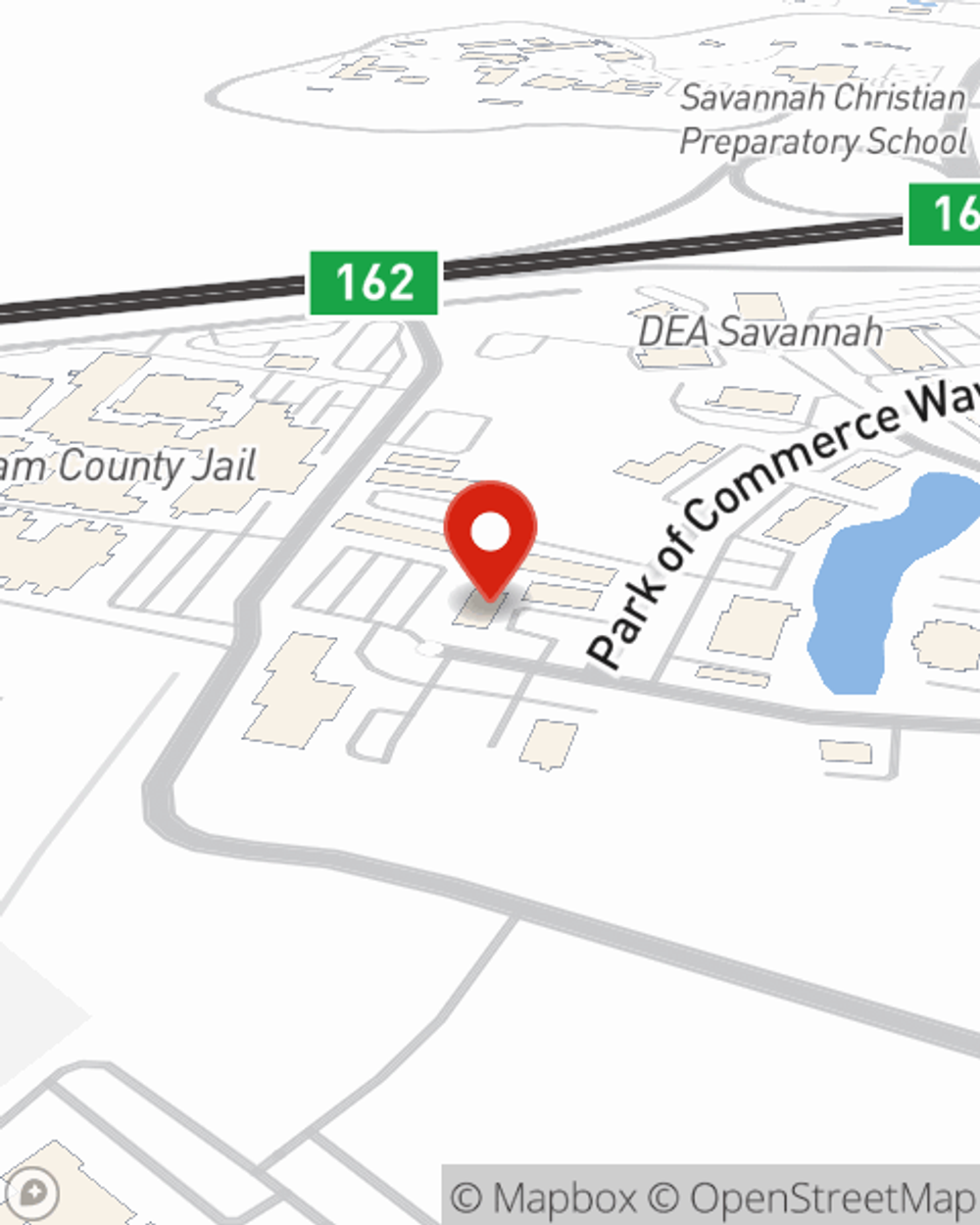

- Savannah

- southbridge

- park of commerce

- savannah quarters

Home Sweet Home Starts With State Farm

Think about all the stuff you own, from your smartphone to desk to silverware to kitchen utensils. It adds up! These belongings could need protection too. For renters insurance with State Farm, you've come to the right place.

Welcome, home & apartment renters of Savannah!

Rent wisely with insurance from State Farm

Renters Insurance You Can Count On

Renting a home makes the most sense for a lot of people, and so is getting insurance to protect your belongings. In general, your landlord's insurance could cover the cost of damage to the structure of your rented home, but that doesn't include your personal belongings. Renters insurance helps protect your personal possessions in case of the unexpected.

As one of the top providers of insurance, State Farm can offer you coverage for your renters insurance needs in Savannah. Get in touch with agent Beth Lanier's office to discover a renters insurance policy that fits your needs.

Have More Questions About Renters Insurance?

Call Beth at (912) 382-0422 or visit our FAQ page.

Simple Insights®

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Beth Lanier

State Farm® Insurance AgentSimple Insights®

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.